Introduction: UK unemployment rate hits 5.1%

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Jobs reports from from both sides of the Atlantic are in focus today, as we get our final health check on the labour markets in the UK and the US.

And the breaking news is that Britain’s unemployment rate has hit a new four-year high, as firms continue to cut jobs.

The UK’s unemployment rate has risen to 5.1% in the August-October period, up from 5% a month ago, to its highest level since the three months to January 2021.

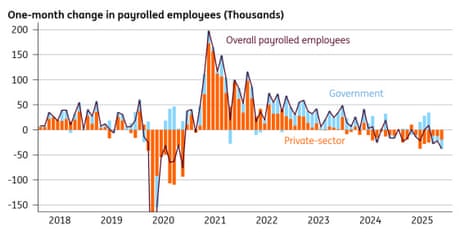

Unemployment rose, again, as the number of people on company payrolls fell; by 149,000 between October 2024 and October 2025, and by 22,000 in October alone.

The ONS also estimates that payrolled employees for November 2025 decreased by 171,000 on the year, and by 38,000 (0.1%) on the month, to 30.3 million.

And with the jobs market cooling, wage growth has slowed again too.

Average earnings, excluding bonuses, rose by 4.6% in the quarter, down from 4.7% a month ago. Total pay growth (including bonuses) slowed to 4.7% from 4.9%.

That weakening in pay growth may encourage the Bank of England to cut interest rates on Thursday.

ONS director of economic statistics Liz McKeown said:

“The overall picture continues to be of a weakening labour market. The number of employees on payroll has fallen again, reflecting subdued hiring activity, while firms told us there were fewer jobs in the latest period.

“This weakness is also reflected in an increase in the unemployment rate, while vacancies remained broadly flat. The fall in payroll numbers and increase in unemployment has been seen particularly among some younger age groups.

Later today we’ll finally get the delayed US non-farm payroll report for November, showing how many jobs were created last month. This report was held up by the US government shutdown, which also meant October’s report was cancelled.

The agenda

-

7am GMT: UK labour market report

-

9am GMT: Eurozone flash PMI report for December

-

9.30am GMT: UK flash PMI report for December.

-

10am GMT: Eurozone trade balance report for October

-

1.30pm GMT: US non-farm payroll jobs report for November

-

1.30pm GMT: US retail sales for October

Key events

Deutsche Bank: Peak Budget uncertainty hits labour market

There are worrying signs in the labour market continue as we head towards Christmas, warns Sanjay Raja, chief uk economist at Deutsche Bank Research.

Raja says:

Peak Budget uncertainty has seemingly impacted hiring plans. The jobless rate hit a new cyclical high of 5.1%. Payrolled employees (after another upward revision to October) dropped by 38k in November (expect this to be revised higher too). The redundancy rate also ticked higher to 156k in the three months to October. Much of the increase in the jobless rate, however, rests on higher participation, which increased by 77k in the three months to October (as opposed to the 43k increase in unemployment).

Regardless, signs of slack are rife. The share of marginally attached workers (those outside the labour market wanting a job) have hit a new cyclical high of 23.4% – its highest rate since the onset of the pandemic (and accounts for a substantial 2.1m people). And looking at the breakdown of the jobless rate, it’s the younger cohorts that have been impacted the most. The 18–34-year-old unemployment rate now sits at 8.7%.

ING: Public sector employment has fallen for three consecutive months

ING’s UK economist James Smith has spotted that government hiring is no longer supporting the jobs market.

He writes:

Companies – especially in retail and hospitality – have been shedding workers this year, partly because of earlier tax and minimum wage hikes. Hiring surveys remain weak.

Until recently, that was helpfully offset by resilience in government hiring, but that appears to be changing. Public sector employment has also now fallen for three consecutive months, judging by those payroll numbers.

Payrolls fall by 193,737 since Labour took power

Pat McFadden may blame the jobs data on “the scale of the challenge” Labour inherited, but today’s report also shows that payrolls have been shrinking since the government took over.

In July 2024, the number of payrolled employees peaked at 30,450,219.

The ONS estimates that in November, there were 30,256,482 – or 193,737 fewer than when Keir Starmer and Rachel Reeves moved into Downing Street.

Hannah Slaughter, senior economist at the Resolution Foundation, says policymakers must take action:

“The labour market is ending the year with a whimper, with falling job numbers and weakening wage growth.

“This means that Britain is likely to usher in 2026 with rising unemployment and the risk that pay packets could start shrinking again. Policy makers need to react to these trends.

“For the Bank, the latest data shows that there may be more space to cut interest rates beyond Thursday’s expected cut. The Government too should be razor focused on Britain’s burgeoning unemployment challenge and redouble efforts to support job creation.”

ICAEW: Budget speculation and slumping economy hurt jobs market

Suren Thiru, ICAEW economics director, warns that the UK jobs market faces ‘a harsh winter’, and blamed the flood of speculation ahead of last months’s budget:

“The UK’s jobs market visibly buckled ahead of the Budget as the unrelenting uncertainty from a torrent of policy speculation and a slumping economy forced more firms to reduce recruitment and curb wage settlements.

“Pay growth should continue easing over the coming months as the squeeze from surging staffing costs and rising unemployment further weakens workers’ negotiating position, despite some upward pressure from the forthcoming minimum wage hike.

“The UK labour market is facing a harsh winter with a perfect storm of surging business costs, including the impending minimum wage rise, and declining customer demand likely to lift unemployment unnervingly higher from here.

IoD: It’s the government’s fault

The Institute of Directors has laid the blame for rising unemployment firmly at the government’s door, calling today’s labour market figures an indictment of its employment policies.

Alex Hall-Chen, principal policy advisor for employment at the Institute of Directors:

“Today’s data shows a further softening of the labour market, with the number of payrolled employees down 0.1% on the month and an increase in the unemployment rate to 5.1%.

“These figures are an indictment of the government’s approach to employment policy; the combined effect of the Employment Rights Bill, employer’s National Insurance increase, and above-inflation increases to the National Living Wage are stifling employer demand for labour.

Yesterday, several business groups (not including the IoD) urged Conservative peers to stop blocking Labour’s workers’ rights bill, following a deal under which new workers would get protection against unfair dismissal after six months, not from day one of employment as previously proposed.

Hall-Chen says more changes are needed:

“While the government’s climbdown on day one unfair dismissal rights is a welcome step, this alone will not turn the tide on job creation. Significant movement on trade union reforms and guaranteed hours provisions, alongside measures to reduce the overall cost of employment, are needed to encourage employers to hire staff.”

McFadden: today’s figures underline the scale of the challenge we’ve inherited

The Work and Pensions Secretary has blamed the rise in unemployment on the “scale of the challenge” Labour inherited when it took power 16 months ago.

Pat McFadden said:

“There are over 350,000 more people in work this year and the rate of inactivity is at its joint lowest in over five years, but today’s figures underline the scale of the challenge we’ve inherited.

“That is why we are investing £1.5 billion to deliver 50,000 apprenticeships and 350,000 new workplace opportunities for young people – giving them real experience and a foot in the door.

“To go further and tackle the deep-rooted issues of our labour market, Alan Milburn is also leading an investigation into the whole issue of young people inactivity and work.”

29,733 people at risk of redundancy in November

The spectre of redundancy is stalking the UK jobs market.

The ONS reports that 29,733 employees are at risk of redundancy, based on the HR1 firms which employers must file if they’re planning to lay at least 20 staff off.

The number of people made redundant in August-October rose to to 5.3 per 1,000 employees, which is an increase on a quarterly basis and also over the last year

Inflation continues to take a large bite out of pay growth.

Using the Consumer Prices Index, annual real regular pay growth (ie, excluding bonuses) was 0.9% in August to October 2025, which is slightly up on the previous three-month period (0.8%).

But annual real total pay growth (including bonuses) fell to 1.0% in August to October 2025, which is slightly down on the previous three-month period (1.1%). That’s the lowest reading since May to July 2023.

UK unemployment rose by 158,000 in the August-October quarter, to a total of 1.832m, lifting the jobless rate to 5.1%.

The number of people in employment dipped by 16,000 in the quarter to 34.226m, which pushed the UK employment rate down to 74.9%.

Public sector pay outstrips private sector

Today’s jobs report also shows the wages in the UK public sector are rising nearly twice as fast as in the private sector.

Annual average regular earnings growth was 7.6% for the public sector and 3.9% for the private sector in August to October.

This is partly due too some public sector pay rises being paid earlier in 2025 than in 2024, causing a base effect.

ONS director of economic statistics Liz McKeown explains:

“Wage growth slowed further in the private sector, while increasing again in the public sector, reflecting the continued impact of some pay rises being awarded earlier than they were last year.”

Introduction: UK unemployment rate hits 5.1%

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Jobs reports from from both sides of the Atlantic are in focus today, as we get our final health check on the labour markets in the UK and the US.

And the breaking news is that Britain’s unemployment rate has hit a new four-year high, as firms continue to cut jobs.

The UK’s unemployment rate has risen to 5.1% in the August-October period, up from 5% a month ago, to its highest level since the three months to January 2021.

Unemployment rose, again, as the number of people on company payrolls fell; by 149,000 between October 2024 and October 2025, and by 22,000 in October alone.

The ONS also estimates that payrolled employees for November 2025 decreased by 171,000 on the year, and by 38,000 (0.1%) on the month, to 30.3 million.

And with the jobs market cooling, wage growth has slowed again too.

Average earnings, excluding bonuses, rose by 4.6% in the quarter, down from 4.7% a month ago. Total pay growth (including bonuses) slowed to 4.7% from 4.9%.

That weakening in pay growth may encourage the Bank of England to cut interest rates on Thursday.

ONS director of economic statistics Liz McKeown said:

“The overall picture continues to be of a weakening labour market. The number of employees on payroll has fallen again, reflecting subdued hiring activity, while firms told us there were fewer jobs in the latest period.

“This weakness is also reflected in an increase in the unemployment rate, while vacancies remained broadly flat. The fall in payroll numbers and increase in unemployment has been seen particularly among some younger age groups.

Later today we’ll finally get the delayed US non-farm payroll report for November, showing how many jobs were created last month. This report was held up by the US government shutdown, which also meant October’s report was cancelled.

The agenda

-

7am GMT: UK labour market report

-

9am GMT: Eurozone flash PMI report for December

-

9.30am GMT: UK flash PMI report for December.

-

10am GMT: Eurozone trade balance report for October

-

1.30pm GMT: US non-farm payroll jobs report for November

-

1.30pm GMT: US retail sales for October

#jobs #market #continues #weaken #unemployment #hits #fouryear #high #wage #growth #slows #business #live #Business