December interest rate cut is ‘nailed on’ after UK GDP shrank in October

Economists are convinced that the Bank of England will respond to the UK’s weak economic performance by cutting interest rates next week.

The Bank’s monetary policy committee will make its final decision of the year on Thursday 18th December, and a rate cut to 3.75% appears highly likely now that the economy shrunk by 0.1% in October.

Ruth Gregory, deputy chief UK economist at Capital Economics, says:

The surprise 0.1% m/m contraction in the economy in October was especially disappointing given the increase in manufacturing output, which rebounded after September’s cyber-attack induced hit, and is a further reason to expect the Bank of England to cut interest rates next Thursday.

Suren Thiru, economics director at the ICAEW, says a pre-Christmas interest rate cut is “nailed on”:

“These figures confirm an off-colour October for the economy, with pre-Budget worries paralysing activity across key sectors, despite a boost to manufacturing from Jaguar Land Rover’s return to production.

“This dismal outturn may have been followed by a similarly turbulent November with the damage to business and consumer confidence from the frenzied speculation ahead of the Budget likely to have frozen wider economic activity.

“The aftereffects from the Budget may mean that the UK’s economic prospects are poorer over the near term, with the growing tax burden and a weakening jobs market likely to keep growth notably lower than the OBR expects.

“With these downbeat figures likely to further fuel fears among rate-setters over the health of the UK economy, a December policy loosening looks nailed on, particularly given the likely deflationary impact of the Budget.”

TUC general secretary Paul Nowak urges the Bank of England to help families and businesses with a rate cut:

“Bringing our economy back on track after 14 years of Tory chaos was never going to be straightforward. A volatile international context is not making this job any easier.

“After years of falling living standards, consumer spending is still very weak.

“The Government acted to boost household incomes at the Budget – it raised minimum wage, benefitting millions across the country, cut child poverty and funded energy payments to support living standards.

“The Bank of England should now recognise the impact that the living standards crisis has had on families’ and businesses’ finances and spending – and must deliver further cuts in interest rates next week”

According to my LSEG screen, an interest rate cut is an 89% chance. Last month, the Bank split 5-4 when they voted to leave rates on hold, so it only needs one voter (likely governor Andrew Bailey) to switch sides….

Key events

November’s GDP report could be “worse” than October’s, warns economist Simon French of Panmure Liberum (who agrees that a rate cut next week is highly likely).

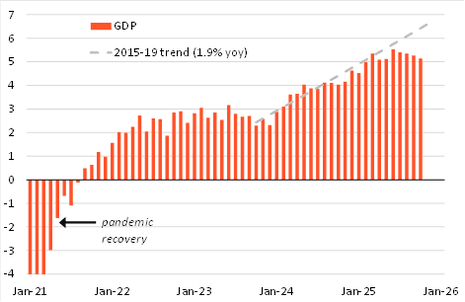

Very soft UK GDP numbers for October -0.1% 3m/3m. Likely to be worse for November given the pre-Budget caution on display across the consumer sector. Nails on a rate cut for next week and raises the chances of mutiple cuts in H1 26. pic.twitter.com/XT64dGwVQS

— Simon French (@Frencheconomics) December 12, 2025

NIESR: No growth since June

Today’s disappointing GDP figures show that the UK economy has seen no growth since June, points out the National Institute of Economic and Social Research.

NIESR associate economist Fergus Jimenez-England warns it is not yet clear whether last month’s budget will lead to stronger growth, saying:

This is especially concerning given that October’s GDP was lifted by a one-off rebound in manufacturing activity following the JLR cyber-attack.

Contractions in both services and construction indicate broad-based weakness, potentially reflecting uncertainty in the run-up to the Budget.

Recent survey data points to continued sluggishness for the remainder of the quarter, though with the Budget now behind us, there is scope for improvement in December.

Looking ahead, the Autumn Budget’s doubling of fiscal headroom should help reduce uncertainty over the coming year. Whether that will translate into stronger economic activity remains to be seen.”

Nationwide fined £44m for financial crime control failings

Oof! Britain’s financial regulator has hit lender Nationwide with a £44m fine for operating “inadequate anti-financial crime systems and controls” from October 2016 to July 2021.

The Financial Conduct Authority says Nationwide had ineffective systems for keeping up-to-date due diligence and risk assessments for all its personal current account customers and for monitoring their transactions.

It adds that Nationwide was also aware that some of those customers were using their personal accounts for business activity, in breach of its terms. As Nationwide didn’t, then, offer business current accounts it didn’t have the correct processes to manage potential financial crime risks.

Therese Chambers, joint executive director of enforcement and market oversight at the FCA, said:

‘Nationwide failed to get a proper grip of the financial crime risks lurking within its customer base. It took too long to address its flawed systems and weak controls, meaning red flags were missed with serious consequences.

These failings have cost the taxpayer £800,000 in Covid fraud, according to the FCA who say:

In one serious case, Nationwide missed opportunities to identify a customer using personal current accounts to receive fraudulent Covid furlough payments. The customer received 24 payments totalling £27.3m over 13 months, with £26.01m of this deposited over 8 days.

His Majesty’s Revenue & Customs (HMRC) recovered £26.5m, but approximately £800,000 remains unrecovered.

Goldman Sachs expects Bank policymakers to vote 6-3 to cut rates

Goldman Sachs predict the Bank of England will cut interest rates next week too.

In a note published yesterday, Goldman economists James Moberly suggests the Bank’s monetary policy committee could split 6-3 in favour of cutting borrowing costs, a month after voting 5-4 to leave rates on hold.

In this scenario, governor Andrew Bailey and deputy governor Clare Lombardelli would leave the ‘no change’ gang and join the cutters.

That would leave chief economist Huw Pill, and external members Megan Greene and Catherine Mann, voting to leave rates on hold due to concerns about inflation.

Moberly explains:

Since the last MPC meeting, the data have come in on the softer side, with a range of indicators pointing to further labour market weakening.

Although the measures introduced at the Budget are likely to generate a small near-term growth boost, they should notably lower inflation next year. As such, the Committee is very likely to cut Bank Rate by 25bp at next week’s (December 18) meeting. We expect a 6-3 vote split – with Pill, Greene, and Mann dissenting in favour of a hold – although the number of dissents (including Lombardelli’s vote) will likely depend on next week’s data.

That data will include the latest unemployment and wage reports, on Tuesday morning.

Economist Douglas McWilliams is concerned that the UK’s tech sector stumbled in October, with “computer programming, consultancy and related activities” shrinking by 3.6%.

Weak GDP data from is before the Budget, though the Chancellor/Treasury led discussion of tax rises pre Budget won’t have helped. Worst news is that the only previously booming sector, tech, has fallen back sharply with computer programming etc down 3.6% on the month.

— Douglas McWilliams (@DMcWilliams_UK) December 12, 2025

Deutsche Bank: There’s a risk UK economy shrinks in Q4

There is a danger that the UK economy shrinks in the final quarter of the year, says Sanjay Raja, chief UK economist at Deutsche Bank.

That would put the UK on the brink of recession (two quarterly contractions in a row).

Raja warns that the road to the new year will be bumpy, saying:

In fact, after today’s data, our nowcasts for growth in the fourth quarter are now running even lower at 0% q/q (our official forecast is for a 0.1% q/q expansion). More worryingly, the skew around our nowcasts lean more negative than positive. And for the first time this year, we see some meaningful risk of a marginal quarterly contraction in real GDP.

If realised this would mark the first quarterly contraction in real GDP since Q4-23. Indeed, Budget uncertainty combined with weak hiring and rising unemployment fear will likely see spending and investment more subdued to end the year.

The good news is that Deutsche Bank expect the UK economy to shake off much of the uncertainty heading into the new year; they forecast growth of 0.5% in January-March 2026, meaning recession would be avoided.

Berenberg: deteriorating fundamentals are to blame, not the budget

Berenberg economist Andrew Wishart reckons deteriorating economic fundamentals, rather than budget uncertainty, are responsible for the contraction in GDP in October.

Wishart explains that this could prompt an interest rate cut next week:

The UK economy has faltered more dramatically than we expected. The 0.1% mom fall in monthly GDP in October (consensus forecast +0.1% mom) extends the cumulative decline in output since June to 0.4%.

The more recent survey data suggests that the malaise has continued since. We suspect that deteriorating fundamentals rather than a Budget-related setback in confidence are to blame, so a recovery seems unlikely in the near term.

This should help ensure that inflation drops swiftly in 2026, allowing the Bank of England to cut bank rate from 4.00% today to 3.00% by next July. The first of these reductions will likely come next Thursday 18 December. Lower BoE rates should then pave the way for a rebound in growth over the course of 2026.

Card Factory blames profit warning on weak consumers

Christmas should be a bumper time for greetings cards sellers, but Card Factory has startled the City with a profits warning this morning.

Card Factory told shareholders that sales have been below expectations, saying:

Over recent months, the pressures facing the UK consumer have been well publicised. It is an inescapable fact that these pressures have impacted consumer confidence and shopping behaviour, contributing to soft high street footfall.

Those conditions have persisted as we moved into our most important trading period, leading to a UK store sales performance which is lower than our previous expectations.

Card Factory now expects to post pre-tax profits of between £55m and £60m this financial year, down from a previous forecast of £70m.

Its shares have plunged by 26% in early trading.

Over in France, inflation remained enviably low last month.

Consumer prices dropped by 0.2% during November, helping to keep the French annual CPI rate at 0.9%, matching October’s reading.

Prices of French services (-0.5%), and manufactured goods (-0.1%) both fell in November, while energy prices rose (+1.3%).

Stride: Labour’s ‘economic mismanagement’ to blame

Shadow chancellor Sir Mel Stride has blamed the government’s ‘mismanagement’ of the economy for the unexpected fall in GDP in October, and in the August-October quarter.

Stride says:

“This morning’s news that the economy unexpectedly shrank in the three months to October is extremely concerning but it’s as a direct result of Labour’s economic mismanagement.

“Rachel Reeves promised growth but Labour has no plan for the economy – just their own survival, that’s why Reeves presented a benefits budget that rewards welfare, not work.

“For months, Rachel Reeves has misled the British public. She said she wouldn’t raise taxes on working people – she broke that promise again. She insisted there was a black hole in the public finances – but there wasn’t.”

December interest rate cut is ‘nailed on’ after UK GDP shrank in October

Economists are convinced that the Bank of England will respond to the UK’s weak economic performance by cutting interest rates next week.

The Bank’s monetary policy committee will make its final decision of the year on Thursday 18th December, and a rate cut to 3.75% appears highly likely now that the economy shrunk by 0.1% in October.

Ruth Gregory, deputy chief UK economist at Capital Economics, says:

The surprise 0.1% m/m contraction in the economy in October was especially disappointing given the increase in manufacturing output, which rebounded after September’s cyber-attack induced hit, and is a further reason to expect the Bank of England to cut interest rates next Thursday.

Suren Thiru, economics director at the ICAEW, says a pre-Christmas interest rate cut is “nailed on”:

“These figures confirm an off-colour October for the economy, with pre-Budget worries paralysing activity across key sectors, despite a boost to manufacturing from Jaguar Land Rover’s return to production.

“This dismal outturn may have been followed by a similarly turbulent November with the damage to business and consumer confidence from the frenzied speculation ahead of the Budget likely to have frozen wider economic activity.

“The aftereffects from the Budget may mean that the UK’s economic prospects are poorer over the near term, with the growing tax burden and a weakening jobs market likely to keep growth notably lower than the OBR expects.

“With these downbeat figures likely to further fuel fears among rate-setters over the health of the UK economy, a December policy loosening looks nailed on, particularly given the likely deflationary impact of the Budget.”

TUC general secretary Paul Nowak urges the Bank of England to help families and businesses with a rate cut:

“Bringing our economy back on track after 14 years of Tory chaos was never going to be straightforward. A volatile international context is not making this job any easier.

“After years of falling living standards, consumer spending is still very weak.

“The Government acted to boost household incomes at the Budget – it raised minimum wage, benefitting millions across the country, cut child poverty and funded energy payments to support living standards.

“The Bank of England should now recognise the impact that the living standards crisis has had on families’ and businesses’ finances and spending – and must deliver further cuts in interest rates next week”

According to my LSEG screen, an interest rate cut is an 89% chance. Last month, the Bank split 5-4 when they voted to leave rates on hold, so it only needs one voter (likely governor Andrew Bailey) to switch sides….

Treasury: We’re determined to defy the forecasts

A Treasury spokesperson has responded to the news that the economy shrank by 0.1% in October, saying:

“We are determined to defy the forecasts on growth* and create good jobs, so everyone is better off, while also helping us invest in better public services.

“That is why the Chancellor is taking £150 off energy bills, protecting record investment in our infrastructure, and we are backing major planning reforms, the expansion of Heathrow and Gatwick airports, and the construction of Sizewell C.”

(* – The City had expected growth of 0.1% in October, so that’s one forecast defied already….)

Budget uncertainty, higher taxes on businesses, weak consumer confidence and Donald Trump’s trade wars all caused the UK economy to contract in October, says Raj Badiani, economics director at S&P Global Market Intelligence.

“Poor real GDP developments for the fourth consecutive month in October shows the impact of poor domestic demand conditions and higher payroll taxes on businesses, driven by fiscal policy changes and higher US tariffs. This has led to significant pressure on UK firms to delay recruitment and investment plans. Meanwhile, consumer confidence is stuck in a rut, hitting discretionary spending alongside triggering unusually high household saving rates.

“The latest leading data suggests continued growth struggles in the next few months, partly reflecting weakened business and consumer confidence due to the Autumn Budget. Growth should improve moderately from mid-2026, underpinned by the government’s significant spending plans and protected by the backloading of the Budget’s main fiscal adjustment measures until 2028. In addition, monetary policy should be less restrictive, with the Bank of England expected to lower the Bank Rate both next week and in February, due to disappointing labour market and GDP data.”

Slump in housebuilding in October

The 0.6% drop in construction output in October shows that the government is struggling to hit its goal of building lots more houses.

The ONS reports that this decrease came from decreases in both new work and repair and maintenance, which decreased by 0.7% and 0.6%, respectively.

At the sector level, the main contributor to the monthly decrease was private new housing, which fell by 2.4%.

The building boom remains devoid of any spark. Construction output was estimated by the @ONS to have decreased by 0.3% in the three months to October 2025 and by 0.6% on September’s efforts. The biggest losers over the month remained private new housing, which fell by 2.4% but… pic.twitter.com/B5vRzrURzm

— Emma Fildes (@emmafildes) December 12, 2025

Britain’s services sector failed to grow in the three months to October, which is a blow as it makes up so much of the economy.

Allow content provided by a third party?

This article includes content hosted on ons.gov.uk. We ask for your permission before anything is loaded, as the provider may be using cookies and other technologies. To view this content, click ‘Allow and continue’.

The ONS reports that output fell in seven of the 14 subsectors that make up the services sector, with the largest negative contributions in:

-

professional, scientific and technical activities (down 1.6%), caused by falls in scientific research and development (down 6.2%) and architectural and engineering activities; technical testing and analysis (down 3.0%)

-

other service activities (down 2.6%), caused by other personal service activities (down 4.6%)

-

information and communication (down 0.4%)

ONS: businesses and customers were waiting for the budget

The ONS identifies pre-budget uncertainty as a factor hitting the economy in October.

In its GDP report, it says:

Businesses across the production, construction and services sectors reported that they, or their customers, were waiting for the outcome of the Autumn Budget 2025 announcement on 26 November 2025.

These comments came from a range of industries, but were mainly from manufacturers, construction companies, wholesalers, computer programmers, real estate firms, and employment agencies.

#December #cut #interest #rates #nailed #economy #shrinks #unexpectedly #October #business #live #Business