UK private sector growth hits six-month high

UK private sector output growth has climbed to a six-month high. in March, in a pre-Spring Statement boost for chancellor Rachel Reeves.

While British manufacturing output is sliding this month, the services sector is growing at a faster rate.

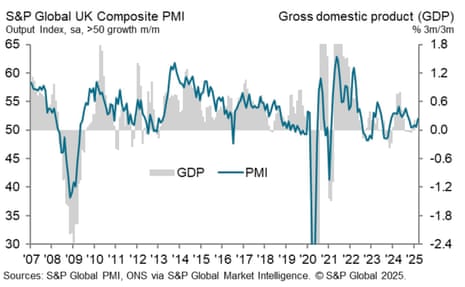

This services rebound has lifted the UK PMI Composite Output Index, which tracks activity in the economy, up to 52.0, the highest since last September, up from 50.5 in February.

S&P Global, which compiles the PMI report, says that service sector growth was bolstered by renewed improvements in both domestic and overseas sales.

But manufacturers were hit by “severe headwinds”, including rising global economic uncertainty and potential US tariffs.

The report says:

Weak international demand resulted in the fastest decline in manufacturing export sales since August 2023. Moreover, manufacturers reported the steepest downturn in production volumes for nearly one-and-a half years.

Here are the details:

-

Flash UK PMI Composite Output Index: 52.0 (Feb: 50.5). 6-month high.

-

Flash UK Services PMI Business Activity Index: 53.2 (Feb: 51.0). 7-month high.

-

Flash UK Manufacturing Output Index: 44.6 (Feb: 47.3). 17-month low.

-

Flash UK Manufacturing PMI: 44.6 (Feb: 46.9). 18- month low.

The report also shows that private sector employment is fallling in March for the sixth month running.

Companies cited business restructuring, investments in automation and the non-replacement of leavers in response to rising payroll costs – a sign that Reeves’s increase to employers’ national insurance rates, and the minimum wage, is hitting workforce levels.

Chris Williamson, chief business economist at S&P Global Market Intelligence said:

“An upturn in business activity in March brings some good news for the government ahead of the Chancellor’s Spring Statement, offering a respite from the recent flow of predominantly downbeat economic data. However, just as one swallow does not a summer make, one good PMI doesn’t signal a recovery.

The signal from the flash PMI is an economy eking out a modest expansion in March, consistent with quarterly GDP growth of just 0.1%, but with employment continuing to be cut thanks to concern over costs and the uncertain outlook. Confidence is still running close to January’s two-year low.

Williamson cautions that the improvement is also being driven by only small pockets of growth, notably in financial services, with consumer-facing business and manufacturers continuing to struggle against headwinds both at home and abroad.

He adds:

These headwinds include the additional costs imposed on businesses in the Budget, low confidence among businesses and households, and sluggish demand at home and abroad, the latter linked to heightened geopolitical uncertainty resulting from US tariff policies.

Worryingly, these headwinds are likely to grow in force as higher National Insurance contributions come into effect in April, coinciding with the anticipated review of US tariff policy on 2nd April, the latter having the potential to further subdue global economic growth and dampen UK trade.”

Key events

Shares in Tesla have jumped 6.6% to $265.23, as Elon Musk’s electric car company recovers some of its recent losses.

Ding ding! Stocks have opened higher in New York, as investors welcome signals that Donald Trump may take a more measured approach with his next flurry of tariffs.

The Dow Jones Industrial Average has jumped by 441 points, or 1.05%, to 42,426 points, while the broader S&P 500 index is up 1.4%.

The tech-focused Nasdaq Composite is 1.6% higher.

As we covered in the introduction (see here), Trump has hinted that he could show flexibility when drawing up the new trade levies to be announced on 2 April, and take a more targeted approach than feared.

BYD sales hit $100bn, overtaking Tesla

Chinese auto giant BYD has overtaken Tesla for sales last year, as it continues to dominate the electric car markets.

Shenzhen-based BYD revenue of 777bn yuan ($107bn) for the 12 months to 31 Deceber 2024, beating forecasts of 766m yuan.

That means BYD brought in more sales than Tesla, which reported total revenues of $97.69bn for 2024.

Bloomberg has more details:

BYD also sells about the same number of EVs as Tesla — 1.76 million in 2024 versus 1.79 million — but, when all of its other passenger hybrid car sales are included, it’s much larger. BYD’s total deliveries last year climbed to 4.27 million, almost as much as Ford Motor Co.

BYD has forecast it can sell between 5 million to 6 million vehicles this year. It’s already off to a strong start, with sales in the first two months of 2025 up 93% year-on-year to 623,300 units.

For the last quarter of 2024, BYD reported a record net profit of 15bn yuan ($2.1bn).

BYD has been making strides into Europe with its entry-level Dolphin and its more premium Seal car, having become China’s largest manufacturer of electric cars.

BYD made a stir last week by reporting that it has developed a new charging system that would make it possible to charge an EV as quickly as it takes to refill with petrol.

Housing affordability in England and Wales back at pre-pandemic levels

Back in the UK, houses across England and Wales have become less unaffordable than at the height of the pandemic.

The Office for National Statistics has reported that housing affordability in England and Wales returned to its pre-pandemic levels last year.

New data today shows that the median average home in England, at £290,000, cost 7.7 times the median average earnings of a full-time employee (£37,600) in 24.

In Wales the average home (£201,000) was 5.9 times annual earnings (£34,300).

The ONS explains:

Affordability in England and Wales in 2024 has returned to its pre-coronavirus (COVID-19) pandemic levels after a sharp increase between 2020 and 2021 (worsening affordability); median house sales prices have increased by 1% since 2021, while average earnings have increased by 20%.

Median annual earnings were £37,600 in England and £34,300 in Wales in 2024.

The median home cost:

· 7.7 times that income at £290,000 in England

· 5.9 times at £201,000 in WalesRead the full article ➡️ https://t.co/TEPEdKMBbZ pic.twitter.com/rKsnnZEJRS

— Office for National Statistics (ONS) (@ONS) March 24, 2025

The report also found:

-

In 2024, 9% of local authorities (LAs) (27) had homes bought for less than five times workers’ earnings on average and were therefore deemed affordable; this is the highest proportion since 2015, but well below that at the start of the series in 1997 (88% of areas).

-

Housing affordability improved in 289 of the 318 LAs in England and Wales (91%) and worsened in 28 (9%) since 2023.

-

The most affordable LAs in 2024 were Blaenau Gwent (with a ratio of 3.8), Burnley (3.9) and Blackpool (3.9); the least affordable was Kensington and Chelsea (27.1, which was about seven times less affordable).

-

Between 2019 and 2024, 4 of the 10 largest increases in affordability ratios (worsening affordability) were in the East Midlands, while the 10 largest decreases in affordability ratios have all occurred in LAs in London

Sales of Tesla’s electric cars in Europe fell behind Volkswagen and the BMW group last month, data by research platform JATO Dynamics shows.

In a report, JATO said that Elon Musk’s role in politics, rising competition in the EV market and the phasing out of the existing version of its best-selling vehicle, the Model Y, have all impacted sales.

Felipe Munoz, Global Analyst at JATO Dynamics, explains:

“Brands like Tesla, which have a relatively limited model lineup, are particularly vulnerable to registration declines when undertaking a model changeover.”

Tesla’s battery-electric vehicle (BEV) registrations in 25 European Union markets, the UK, Norway and Switzerland fell on average by 44% from the same month of 2024, to under 16,000 cars sold in February, according to JATO.

Its market share in the month fell to 9.6%, the lowest February reading in the last five years.

By comparison, Volkswagen’s BEV sales were up 180% to under 20,000 cars, while the BMW brand and BMW-owned Mini, combined, sold almost 19,000 BEVs in February, the data showed.

Here’s some expert reaction to this morning’s news that UK private sector growth has hit a six-month high this month.

Ashley Webb, UK economist at Capital Economics:

Despite the rise in the composite activity PMI in March, it’s still consistent with the near-stagnation in GDP in recent quarters continuing in Q1. More positive were signs that businesses intend to shed jobs by less than previously feared to cope with higher taxes.

But with price pressures still elevated, the BoE will be concerned about the growing upside risks to inflation.

Thomas Pugh, economist at audit, tax and consulting firm RSM UK:

“The rise in the flash S&P Global UK Composite PMI for March to 52.0 suggests the domestic economy regained a little bit of momentum at the end of Q1, but the manufacturing sector is still suffering. However, this will offer little consolation to Rachel Reeves before her speech on Wednesday, where she will have to announce around £10bn of spending cuts.

“The difference between the services and manufacturing sectors was even starker than usual in March. The manufacturing PMI dropped to 44.6, its lowest since September 2023, primarily driven by weak export sales as tariff uncertainty continues to weigh on the sector. Meanwhile, the services PMI rose to 53.2, its highest in almost a year.

“The employment balance jumped to 47.4, which still suggests private sector employment is falling. Admittedly, the PMI is probably overstating the weakness in the jobs market. But a weak labour market combined with the input price balance dropping a little may give the Bank of England a bit more confidence to cut interest rates in May.

“Overall, it seems like the domestic economy is now finding its feet after a stumble around the budget. But weak global growth and surging uncertainty about US tariff policy is hammering the external sector, especially manufacturing products, dragging on total growth.”

Rhys Herbert, senior economist at Lloyds:

“The uplift in business activity is testament to the hard work undertaken by businesses when faced with challenging economic and geopolitical conditions. This boost aligns with data from our latest Business Barometer, which shows that confidence rose to its highest level since August 2024, reflecting improved economic optimism and stronger trading prospects across sectors.”

Software maker SAP overtakes Novo Nordisk to become Europe’s largest company

Novo Nordisk, the Danish drugmaker, has been unseated from its position as Europe’s most valuable company.

The firm behind obesity and diabetes injections Wegovy and Ozempic has been overtaken by German software firm SAP for market capitalisation.

Reuters has calculated that at 9am, SAP had a market cap of $340bn, slightly more than Novo Nordisk.

BBG: German software giant SAP claimed the title of Europe’s most valuable public company, surpassing Danish weight-loss drug maker Novo Nordisk. SAP shares have risen 42% in the past year as customers shift from traditional on-site servers to IT infrastructure on the cloud. pic.twitter.com/W8FdKHwRuG

— Kong Kong Kubs (@3benson) March 24, 2025

SAP produces a range of business application software, and has benefitted from forecasts that its cloud business will benefit from the artificial intelligence boom.

SAP’s shares are up 10% so far this year, and up almost 40% over the last 12 months.

Novo Nordisk became Europe’s largest company in September 2023, due to strong demand for its weightloss drugs.

But last August, Novo Nordisk cut its annual profit expectations after posting weaker-than-expected sales of Wegovy. It also faces the threat of tariffs, especially if Donald Trump continues his push to take control of Greenland from Denmark.

Bank of England launches 2025 bank stress test

The Bank of England has launched the 2025 Bank Capital Stress Test for the seven largest and most systemic UK banks and building societies.

The stress test will assess whether UK banks have enough capital to survive a financial crisis.

This year’s test will model a “severe global aggregate supply shock” that leads to deep recessions in both the UK and globally.

This scenario includes:

-

UK GDP falls by 5% in the early part of the scenario;

-

World GDP falls by 2%;

-

UK unemployment almost doubles to a peak rate of 8.5% in the third year of the scenario, similar to the peak level experienced in the global financial crisis.

-

World trade falls by 20%;

-

Oil and gas prices rise sharply;

-

Inflation peaks at 10% before falling back to the 2% target by the end of the scenario;

-

Bank Rate is increased to a peak of 8% and is then lowered over the scenario as inflation returns to the target;

-

UK residential property prices fall by 28%.

The results will be published in the fourth quarter of this year.

The banking sector has generally passed previous stress tests. In 2023, the UK’s largest banks were strong enough to weather a £125bn financial hit during a severe economic downturn, while in 2021 the UK’s top eight banks could withstand a near tripling of national unemployment, a sharp fall in property prices and a large economic contraction.

But back in 2014, the Co-operative Bank failed the test, while Lloyds Banking Group and Royal Bank of Scotland only just scraped through.

Today’s UK PMI report also shows that business confidence remains shaky this month.

Confidence among manufacturers was the weakest since November 2022. However, optimism among service providers edged up to a five-month high.

The report says:

Service sector firms noted a gradual improvement in sales opportunities and projections for organic growth, despite lingering concerns about constrained business investment and the impact of rising payroll costs on client demand. In the manufacturing sector, there were many concerns about US tariffs and gloomy forecasts for export sales due to volatility in global markets.

UK companies are continuing to raise prices at a ‘robust’ rate this month, today’s poll of purchasing managers shows.

Prices at the factory gate have accelerated to the fastest rate since April 2023, but this was balanced by a slight slowdown in price growth in the service sector.

Thus, the overall rate of output charge inflation was unchanged compared with February.

The PMI report says:

Forthcoming increases to National Insurance contributions and the National Minium Wage were cited as the main reasons for higher output prices, but there were also sporadic reports of discounting to stimulate sales.

UK private sector growth hits six-month high

UK private sector output growth has climbed to a six-month high. in March, in a pre-Spring Statement boost for chancellor Rachel Reeves.

While British manufacturing output is sliding this month, the services sector is growing at a faster rate.

This services rebound has lifted the UK PMI Composite Output Index, which tracks activity in the economy, up to 52.0, the highest since last September, up from 50.5 in February.

S&P Global, which compiles the PMI report, says that service sector growth was bolstered by renewed improvements in both domestic and overseas sales.

But manufacturers were hit by “severe headwinds”, including rising global economic uncertainty and potential US tariffs.

The report says:

Weak international demand resulted in the fastest decline in manufacturing export sales since August 2023. Moreover, manufacturers reported the steepest downturn in production volumes for nearly one-and-a half years.

Here are the details:

-

Flash UK PMI Composite Output Index: 52.0 (Feb: 50.5). 6-month high.

-

Flash UK Services PMI Business Activity Index: 53.2 (Feb: 51.0). 7-month high.

-

Flash UK Manufacturing Output Index: 44.6 (Feb: 47.3). 17-month low.

-

Flash UK Manufacturing PMI: 44.6 (Feb: 46.9). 18- month low.

The report also shows that private sector employment is fallling in March for the sixth month running.

Companies cited business restructuring, investments in automation and the non-replacement of leavers in response to rising payroll costs – a sign that Reeves’s increase to employers’ national insurance rates, and the minimum wage, is hitting workforce levels.

Chris Williamson, chief business economist at S&P Global Market Intelligence said:

“An upturn in business activity in March brings some good news for the government ahead of the Chancellor’s Spring Statement, offering a respite from the recent flow of predominantly downbeat economic data. However, just as one swallow does not a summer make, one good PMI doesn’t signal a recovery.

The signal from the flash PMI is an economy eking out a modest expansion in March, consistent with quarterly GDP growth of just 0.1%, but with employment continuing to be cut thanks to concern over costs and the uncertain outlook. Confidence is still running close to January’s two-year low.

Williamson cautions that the improvement is also being driven by only small pockets of growth, notably in financial services, with consumer-facing business and manufacturers continuing to struggle against headwinds both at home and abroad.

He adds:

These headwinds include the additional costs imposed on businesses in the Budget, low confidence among businesses and households, and sluggish demand at home and abroad, the latter linked to heightened geopolitical uncertainty resulting from US tariff policies.

Worryingly, these headwinds are likely to grow in force as higher National Insurance contributions come into effect in April, coinciding with the anticipated review of US tariff policy on 2nd April, the latter having the potential to further subdue global economic growth and dampen UK trade.”

Eurozone manufacturing returns to growth

Happy news: the eurozone’s factory sector has returned to growth this month, perhaps thanks to a rush to beat new US tariffs.

S&P Global’s poll of purchasing managers from across Europe’s private sector has found that manufacturing production has increased for the first time in two years, even though new orders fell again.

Here’s the details (where any reading over 50 shows growth):

-

HCOB Flash Eurozone Composite PMI Output Index at 50.4 (February: 50.2). 7-month high.

-

HCOB Flash Eurozone Services PMI Business Activity Index at 50.4 (February: 50.6). 4-month low.

-

HCOB Flash Eurozone Manufacturing PMI Output Index at 50.7 (February: 48.9). 34-month high.

-

HCOB Flash Eurozone Manufacturing PMI at 48.7 (February: 47.6). 26-month high

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“Just in time with the beginning of spring we may see the first green shoots in manufacturing. While we should not be carried away by a single data point, it is noteworthy that manufacturers expanded their output for the first time since March 2023. It’s also encouraging, that the index output has risen for three months straight. This is complemented by a much softer fall in new orders and employment.

One could pour some cold water on this development arguing that it’s the temporary tariff-related import boom from the US which has driven the improvement in manufacturing. However, given the will of Europe, to invest heavily in defense and infrastructure – in Germany a corresponding historical fiscal package has been approved only last week – hope for a more sustained recovery seems well founded.

The price development in the services sector, which is very much under scrutiny of the ECB, will be well received by the doves of the monetary authority. Both input costs and selling prices are rising at a slower pace compared to recent months.

Lower input cost inflation points to less pressure from wages which are a key ingredient of input costs in the labour intensive services sector. Meanwhile, in manufacturing, price increases for both selling and purchasing remain moderate, helped along by declining energy costs.

#private #sector #growth #hits #sixmonth #high #boost #Reeves #business #live #Business