Introduction: Bank of England warns of risk of ‘sharp correction’ due to AI valuations

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Risks to the financial stability of the UK have increased during 2025, the Bank of England is warning this morning, as it cites the risk of a stock market crash triggered by highly-valued AI companies.

The Bank is issuing its latest assessment of the UK financial system, and warning that the global risks threatening the country remain “elevated”, citing geopolitical tensions, fragmentation of trade and financial markets, and pressures on sovereign debt markets.

These elevated geopolitical tensions increase the likelihood of cyberattacks and other operational disruptions, the Bank points out, also citing the “material uncertainty in the global macroeconomic outlook”.

And the Bank singles out the surge in valuations of artificial intelligence companies this year, saying that this “heightens the risk of a sharp correction”.

The Bank’s Financial Policy Committee say that many risky asset valuations remain “materially stretched”, particularly for technology companies focused on AI, adding:

Equity valuations in the US are close to the most stretched they have been since the dot-com bubble, and in the UK since the global financial crisis (GFC). This heightens the risk of a sharp correction.

AI companies have been driving the US stock market higher this year. Shares in chipmaker Nvidia, for example, are up 34% this year despite a 10% drop in the last month.

The FPC also sounds the alarm about the use of debt financing in the AI sector, and the web of multi-billion dollar deals between the various companies, explaining:

By some industry estimates, AI infrastructure spending over the next five years could exceed five trillion US dollars. While AI hyperscalers will continue to fund much of this from their operating cash flows, approximately half is expected to be financed externally, mostly through debt.

Deeper links between AI firms and credit markets, and increasing interconnections between those firms, mean that, should an asset price correction occur, losses on lending could increase financial stability risks.

More details to follow…

The agenda

-

7am GMT: Nationwide house price index for November

-

7am GMT: Bank of England publishes its latest Financial Stability Report,

-

7am GMT: Bank of England publishes its latest stress test results

-

10am GMT: Bank of England press conference with governor Andrew Bailey, and deputy governors Sarah Breeden and Sam Woods

-

10am GMT: OECD releases its latest economic outlook

-

10am GMT: Treasury Committee hearing on the budget with the OBR

Key events

The London stock market is calm this morning, with the FTSE 100 gaining 10 points or 0.11% to 9713 points in early trading.

The Bank of England’s financial stability report does not seem to have alarmed the City.

Kathleen Brooks, research director at XTB, explains:

There are residual concerns about an AI bubble, the FT is reporting that British pension funds have been reducing their equity allocations to the US and moving into other regions as fears grow about an AI bubble and concentration risk. The trend is to increase allocations to UK and Asian markets, and this could be a big theme in 2026.

When the institutional money makes a move, it is worth noting, since they tend to be juggernauts that take a while to change direction. If UK pension funds are turning away from the US and looking globally for returns, this could signal that the valuation gap between the US and elsewhere might start to narrow. This is a theme that has been around for a while, but it might start bearing fruit.

The Bank of England is also getting in on the act, and in its latest Financial Stability Report, released this morning, it once again flagged the risks from high valuations, specifically from AI stocks and it said that ‘global risks remain elevated.’ However, trading financial markets are all about managing risk, and we do not think that these comments will dramatically alter the outlook for stocks in the near term.

UK house prices up in November

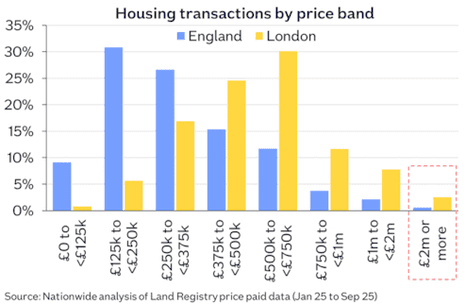

UK house prices rose last month despite uncertainty before the budget, according to new data from Nationwide.

The UK’s biggest building society said the average house price rose 0.3% month on month in November, higher than a 0.1% increase predicted by economists polled by Reuters. The average price of a home was £272,998, up from £272,226 in October.

But on an annual basis, house price inflation slowed to 1.8% in November, down from 2.4% in the year to October.

Robert Gardner, Nationwide’s chief economist, has predicted that the newly announced “mansion tax” would have a limited impact on the housing market.

“The changes to property taxes announced in the Budget are unlikely to have a significant impact on the housing market. The high value council tax surcharge, which is not being introduced until April 2028, will apply to less than 1% of properties in England and around 3% in London.

More here:

Karim Haji, global and UK head of financial services at KPMG, has welcomed the decision to ease the capital requirements on UK banks:

“UK Financial Services firms have proved resilient time and again both by regulatory stress tests and real life shocks. But global risks persist. The Financial Stability Report rightly points to continued structural risks from issues like cyber and the private client market.

The past year has shown that risks aren’t confined to traditional economic shocks and when an event happens the impacts are felt immediately due to the interconnectedness of the financial system and technology.

“Regulations need to be robust but proportionate and UK banks have huge pools of capital. The recommendation to update the CET1 benchmark is a helpful step towards maintaining the UK’s resilience whilst also being supportive of growth.”

BoE plans to loosen capital rules on banks in latest easing of post-2008 controls

Kalyeena Makortoff

The Bank of England is planning to ease capital rules for high street banks for the first time in a decade, marking the latest attempt to loosen regulations designed to protect the UK economy in the wake of the 2008 financial crisis.

The central bank has proposed lowering capital requirements related to risk weighted assets, by one percentage point to about 13%, reducing the amount lenders must hold in reserve. The move is designed to make it easier to lend to households and businesses.

Capital requirements act as a financial cushion against risky lending and investments on bank balance sheets.

It came as fresh stress tests showed that the UK’s seven largest banks – Barclays, Lloyds Banking Group, Nationwide, NatWest, Santander UK and Standard Chartered – are strong enough to continue lending through “a severe but plausible” economic downturn [see previous post].

The Bank said its proposed new capital rules were “consistent with its view that the banking sector can support long-term growth in the real economy in both current and adverse economic environments”.

More here:

UK banks pass stress test

Britain’s seven largest banks have all passed the latest stress tests carried out by the Bank of England.

The BoE announded this morning that all seven lenders have enough capital to withstand a deep global recession, large falls in financial markets and a jump in interest rates.

This means Barclays, Lloyds Banking Group, Nationwide, NatWest, Santander UK and Standard Chartered are strong enough to continue lending through “a severe but plausible” economic downturn, in the Bank’s view.

Announcing the results alongside today’s financial stability report, the Bank says:

The results of the 2025 Bank Capital Stress Test demonstrate that the UK banking system is able to continue to support the economy even if economic and financial conditions turn out to be materially worse than expected. This underscores the role of financial stability as a pre-condition for sustainable growth.

The Stress Test examined how the banks would fare if they faced a severe negative global supply disruption that led to deep recessions across global economies.

The report found that no individual bank needs to strengthen its capital position as a result of the test, but there were differences in how they performed:

-

UK-focused banks – Lloyds Banking Group, Nationwide Building Society, NatWest Group and Santander UK Group Holdings plc were most affected by the UK macroeconomic stress, driven by higher interest rates, inflation, unemployment and house price falls.

-

Internationally-diversified banks – Barclays plc, HSBC Holdings plc and Standard Chartered plc faced additional pressures from global downturns and traded risk shocks in markets such as Hong Kong, China, the US and Europe.

Bank: gilt repo market poses risks

Hedge funds who dabble in the market for UK government bonds in the search for profits are another threat to the country’s financial stability.

The Bank of England’s new financial stability report shows that leveraged borrowing by hedge funds in gilt repo markets “remains elevated”, reaching close to £100 billion in November.

This activity is related to the popularity of the “cash-futures basis trade”, the Bank suggests. That’s the arbitrage strategy that involves profiting from the temporary price difference between a financial asset’s cash market price and its futures contract price.

The Bank fears this could create market instability, if hedge funds all tried to pile out of the market at the same time, saying:

A small number of hedge funds account for more than 90% of net gilt repo borrowing, with trades often transacted at zero or near-zero collateral haircuts and at very short maturities and so require regular refinancing. These vulnerabilities, in the context of compressed risk premia in a highly uncertain global environment, increase the risk of sharp moves.

Funds could need to deleverage simultaneously in response to a shock if funding conditions tightened to the extent that refinancing became unavailable or prohibitively expensive. This reinforces the need for market participants to ensure the risk management of their positions takes account of potential shocks, including correlation shifts outside historical norms.

Back in September, the Bank published a discussion paper evaluating various reforms to enhance the resilience of the gilt repo market. However, any structural reforms will take time to implement, so it is urging market participants ensuring they are preared for shocks.

Bank: Renters could pose financial stability risks

Overall, the ratio of UK household savings to income remains elevated, which should provide resilience to potential future shocks.

But, the Bank warns, some groups are more vulnerable to economic shocks than others.

And it singles out renters as one vulnerable group, citing evidence that the gap in median savings to income between outright owners and renters has widened this year.

While falling rental price inflation is likely to somewhat ease pressures on renters, renters also continue to be more likely to report financial difficulty and insufficient emergency savings.

Around 35% of households are renters, so sharp spending cuts or defaults on their financial obligations in the event of economic shocks can pose financial stability risks [this blog post has more details].

UK household indebtedness levels have continued to fall since July, the Bank reports.

It believes it would take a ‘very severe shock’, which drove up interest rates and hammered incomes, for households’ mortgage costs to hit historically painful levels.

It says:

The aggregate debt to income ratio remained low at 132% in 2025 Q2, having fallen to its lowest level since 2002. The share of household income spent on mortgage repayments (debt-servicing ratio (DSR)) was flat at 7.3% in Q2 and is expected to remain around this level over the coming years. Sensitivity analysis by Bank staff shows that it would take a very severe shock to incomes and mortgage spreads for aggregate household DSRs to reach historic peaks.

Chart: Why Bank of England is worried about AI valuations

The Bank of England has also produced a neat chart to show how AI stocks have driven the high valuation and growth of the US stock market, as investors have piled in on the expectation of high future earnings growth.

It shows the year-to-date price change of S&P 500 stocks (y-axis), and the next 12 month price-to-earnings ratio for each stock (x-axis).

(b) The size of dots corresponds to the market capitalisation of firms as of 24 November 2025.

(c) ‘AI stocks’ are those which appear in the JPAIM equity basket. Photograph: Bank of England

As you can see, many AI stocks are trading at a higher price-to-earnings ratio than the rest of Wall Street, a sign that much higher profits are expected in future years.

As the Bank explains:

The share prices of many AI companies are partly underpinned by high expected future earnings growth over several years, contributing to those companies – and subsequently the equity indices which they comprise a significant part of – appearing historically expensive in valuation metrics which consider past, current or only near-term future earnings [see chart above].

The US excess cyclically-adjusted price-to-earnings (CAPE) yield – a measure of equity risk premia (ERP) which considers past earnings – is close to its lowest level since the dot-com bubble. CAPE is a backward-looking measure, but even ERP calculated from the excess yield of three-year forward earnings expectations is at its most compressed level in 20 years. Whether these earnings will be realised, or even prove underestimates, is uncertain.

The Bank is also concerned about the large volume of corporate debt issued by some AI companies in the second half of 2025. So far, the bond market has bought this debt without complaint.

But… the BoE fears this situation may not last, and points out that the cost of insuring Oracle’s debt against default has risen since the summer.

It says:

The bond market has absorbed this issuance so far – US IG corporate bond spreads remain near their lowest level over the past 15 years.

But debt securities and credit derivatives associated with AI companies can quickly reprice in response to changes in outstanding debt volumes and/or future earnings expectations.

For example, the five-year credit default swap spreads of Oracle – an AI company which has lower free cash flow margins than some other larger hyperscalers and has issued a large amount of debt this year to finance AI infrastructure spending – has widened from less than 40 basis points to around 120 basis points since end-July (by contrast, the credit default swap spreads of US IG corporates more broadly – as proxied by the CDX North American IG five-year index – are broadly unchanged over the same period).

Bank: the UK is exposed to global shocks

The good news from today’s financial stability report is that the Bank of England believes the UK banking system is well capitalised, maintains robust liquidity and funding positions, and asset quality remains strong.

UK household and corporate aggregate indebtedness remains low too.

But, today’s Financial Stability Report also warns that the UK is notably vulnerable to global shocks that ripple through the global economy, saying:

As an open economy with a large financial centre, the UK is exposed to global shocks, which could transmit through multiple, interconnected channels. Stress in one market, such as a sharp asset price correction or correlation shift, could spillover into other markets.

Simultaneous de-risking by banks and non-banks can lead to fire sales, widening spreads and tightening financing conditions for UK households and corporates. Market participants should ensure their risk management incorporates such scenarios.

Rising government debts are another threat, the Bank adds, reminding us that public debt-to-GDP ratios in many advanced economies have continued to rise this year.

The Financial Policy Committee say:

Governments globally face spending pressures, given the context of changing demographics and geopolitical risk, potentially constraining their capacity to respond to future shocks. Significant shocks to the global economic or fiscal outlook, should they materialise, could be amplified by vulnerabilities in market-based finance (MBF), such as leveraged positions in sovereign debt markets.

[MBF is the name for the network of markets (for shares, debt or derivatives) the companies which use them such as investment funds and insurers, and market infrastructure].

Bank: corporate defaults could impact bank resilience and credit markets

The Bank of England also cites the credit markets as a potential risk to the economy.

It points to the failure this autumn of US companies First Brands and Tricolor, which have already raised concerns about weak lending standards and potential threats from the so-called shadow banking sector.

The financial stability report says:

Credit spreads remain compressed by historical standards.

Two recent high-profile corporate defaults in the US have intensified focus on potential weaknesses in risky credit markets previously flagged by the FPC. These include high leverage, weak underwriting standards, opacity, complex structures, and the degree of reliance on credit rating agencies, and illustrate how corporate defaults could impact bank resilience and credit markets simultaneously.

Introduction: Bank of England warns of risk of ‘sharp correction’ due to AI valuations

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Risks to the financial stability of the UK have increased during 2025, the Bank of England is warning this morning, as it cites the risk of a stock market crash triggered by highly-valued AI companies.

The Bank is issuing its latest assessment of the UK financial system, and warning that the global risks threatening the country remain “elevated”, citing geopolitical tensions, fragmentation of trade and financial markets, and pressures on sovereign debt markets.

These elevated geopolitical tensions increase the likelihood of cyberattacks and other operational disruptions, the Bank points out, also citing the “material uncertainty in the global macroeconomic outlook”.

And the Bank singles out the surge in valuations of artificial intelligence companies this year, saying that this “heightens the risk of a sharp correction”.

The Bank’s Financial Policy Committee say that many risky asset valuations remain “materially stretched”, particularly for technology companies focused on AI, adding:

Equity valuations in the US are close to the most stretched they have been since the dot-com bubble, and in the UK since the global financial crisis (GFC). This heightens the risk of a sharp correction.

AI companies have been driving the US stock market higher this year. Shares in chipmaker Nvidia, for example, are up 34% this year despite a 10% drop in the last month.

The FPC also sounds the alarm about the use of debt financing in the AI sector, and the web of multi-billion dollar deals between the various companies, explaining:

By some industry estimates, AI infrastructure spending over the next five years could exceed five trillion US dollars. While AI hyperscalers will continue to fund much of this from their operating cash flows, approximately half is expected to be financed externally, mostly through debt.

Deeper links between AI firms and credit markets, and increasing interconnections between those firms, mean that, should an asset price correction occur, losses on lending could increase financial stability risks.

More details to follow…

The agenda

-

7am GMT: Nationwide house price index for November

-

7am GMT: Bank of England publishes its latest Financial Stability Report,

-

7am GMT: Bank of England publishes its latest stress test results

-

10am GMT: Bank of England press conference with governor Andrew Bailey, and deputy governors Sarah Breeden and Sam Woods

-

10am GMT: OECD releases its latest economic outlook

-

10am GMT: Treasury Committee hearing on the budget with the OBR

#valuations #heighten #risk #sharp #correction #Bank #England #warns #banks #pass #stress #tests #business #live #Business